Everywhere online right now, people are sharing how much their lives have changed over the last 10 years. Careers. Families. Finances. So when the National Association of Realtors released a 10-year housing update, I paid attention.

And honestly, some of the data stopped me in my tracks.

As both a Realtor and a consumer, this data genuinely concerns me. At the same time, I think parts of the conversation miss some important context. The truth is more nuanced than the headlines suggest.

This is my take on the housing affordability 2016 vs 2025 conversation.

The Data Tells a Tough Story at First Glance

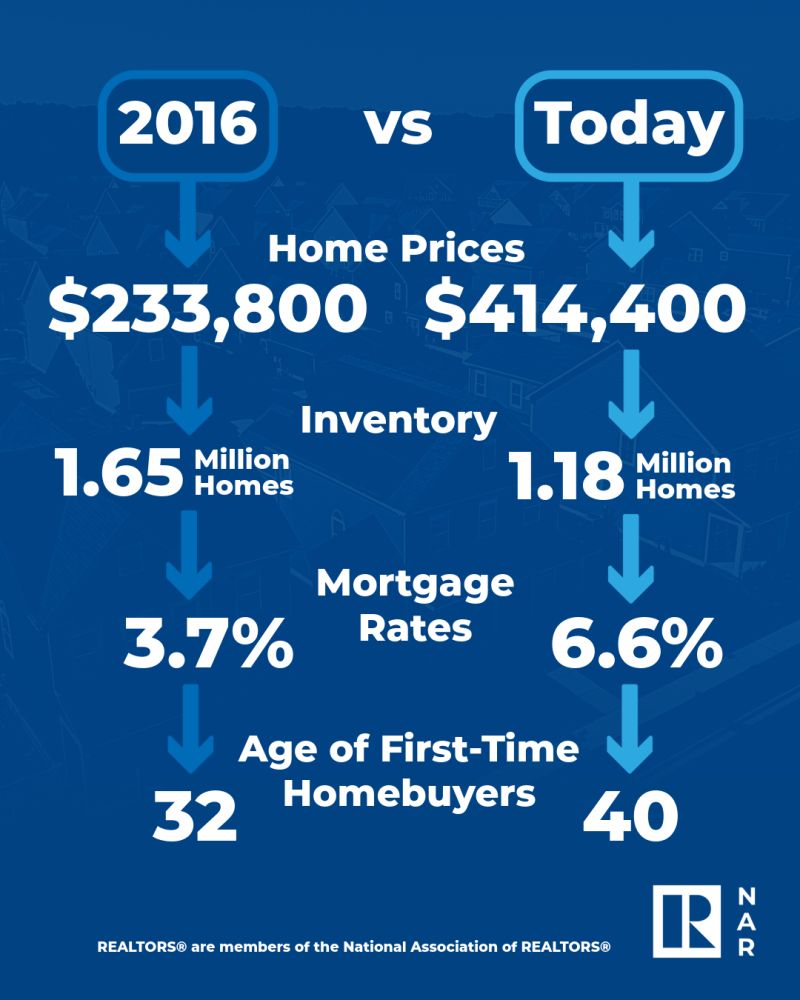

Here is what the national housing market looks like when you compare 2016 to today.

Home prices

In 2016, the median home price was $233,800.

In 2025, it sits around $414,400.

That is a 77 percent increase.

Inventory

In 2016, about 1.65 million homes were for sale.

In 2025, that number is closer to 1.18 million.

We are still short roughly 470,000 homes.

Home sales

About 5.45 million homes sold in 2016.

Roughly 4.06 million sold in 2025.

That is a difference of 1.39 million transactions.

Mortgage rates

Rates averaged about 3.7 percent in 2016.

In 2025, they hover near 6.6 percent.

Housing affordability

The affordability index in 2016 was 166.2.

That meant the typical family earned about 66 percent more than needed to qualify.

By the end of 2025, the index dropped to 108.2.

Homes are still technically affordable, but barely.

First time buyer age

The median age jumped from 32 to 40.

That eight year shift matters more than people realize.

On paper, this looks bleak. I get why buyers feel discouraged.

The Part We Do Not Talk About Enough

Here is where I think nostalgia gets selective.

Yes, buying a home in 2016 was easier. Prices were lower. Rates were lower. Entry felt simpler.

But once you owned, the picture was different.

In 2016, the average homeowner had built less than $15,000 in equity over ten years. The market was still recovering from the housing crash. Many owners had limited flexibility. Moving up felt risky. Renovations were harder to justify. Life changes often came with financial stress.

Fast forward to today.

The average homeowner has gained about $214,210 in equity over the last decade. That number still surprises people. It should.

Equity changes everything. It creates options. It provides a buffer. It allows people to move, remodel, downsize, or pivot without starting from scratch.

So while housing affordability 2016 vs 2025 clearly shows that entry became harder, ownership became far more powerful.

Why This Matters to Me as a Realtor

I work with buyers every day who feel like they missed their chance. I hear the frustration. I feel it too.

That is exactly why I am so committed to helping my buyers get into homes they can afford now. Not perfect homes. Not forever homes. Smart first homes.

Real estate is still one of the most reliable ways to build long term wealth. The hardest part is getting your foot in the door. Once you are in, time and equity start working for you.

I never want fear or comparison to be the reason someone stays on the sidelines.

How New Builds Fit Into This Conversation

This is also why I continue to talk about new construction.

While new builds are not a cure-all, they play an important role right now. Builders are increasing supply, and single-family housing starts are up about 20 percent compared to 2016.

In addition, many builders offer incentives that help offset higher interest rates. For some buyers, predictable costs and fewer immediate repairs make ownership more achievable.

For many of my clients, new construction creates a practical entry point when resale options feel out of reach. That connection is why this data ties directly to my recent blog post on new builds. Check out that post here!

A Tucson Perspective

Here in Tucson and the surrounding areas, these trends feel very real. Our market continues to see limited resale inventory and steady demand. At the same time, new construction in places like Vail, Marana, and Oro Valley provides buyers with additional options.

Because every neighborhood behaves differently, local strategy matters more than ever. Pricing, builder incentives, and timing all play a role.

Looking Ahead

I do believe 2026 will bring better balance. Supply is improving. Builders are adjusting. Buyers will have more options than they have had in years.

Until then, my focus stays the same. I want my buyers to buy smart, stay within their comfort zone, and start building equity sooner rather than later.

The market changed. The opportunity did not disappear. It just looks different now.

I share local market updates, buyer strategies, and behind-the-scenes real estate life on Instagram. If you want to follow along, I’d love to have you there. Click here to head to my Instagram!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link